UK Supermarkets See Sales Growth Amid Shifting Consumer Habits

Table of Contents

- Key Highlights

- Introduction

- A Closer Look at Sales Growth

- The Shift to Healthier Eating

- Retailer Performance Overview

- Consumer Confidence and Economic Outlook

- Conclusion

- FAQ

Key Highlights

- Total till sales at UK supermarkets increased by 3.8% in the four weeks ending June 14, 2025, up from 3% in May.

- In-store visits rose by 4.5%, while average spending per visit decreased by 2.5% to £18.61.

- Health-conscious shopping trends are on the rise, with significant growth in categories like big pot yogurts (+29%) and frozen fruits (+21%).

- Retailers Tesco and Sainsbury’s reported sales increases of 6.6% and 5.8%, respectively, while Ocado led with a 15.6% growth.

- A majority (66%) of UK shoppers are actively seeking to improve their health and wellness.

Introduction

As the days grow longer and temperatures rise, UK supermarkets are witnessing a noteworthy uptick in sales. Total till sales have surged by 3.8% in the four weeks leading up to mid-June 2025, according to recent data from NielsenIQ (NIQ). This increase comes against a backdrop of fluctuating consumer confidence and ongoing inflation, prompting shoppers to seek better deals and healthier options. With nearly 90% of UK households placing a high priority on their health, the dynamics of grocery shopping are evolving in significant ways.

The recent reports highlight not only the resilience of the supermarket sector amid economic challenges but also a marked shift in consumer behavior towards healthier eating habits. In this article, we delve into the factors driving these changes, the implications for retailers, and what the future may hold for the UK grocery landscape.

A Closer Look at Sales Growth

NielsenIQ's latest findings indicate that the increase in total sales is partially attributed to favorable weather conditions, which have encouraged outdoor dining and family gatherings, particularly around Father’s Day. However, this growth is tempered by a noted decline in average spending per visit, which fell by 2.5% to £18.61. This trend reflects a cautious approach by consumers as they navigate rising inflation and economic uncertainty.

Key Factors Influencing Sales Growth

- Weather Influence: Warm weather has spurred an increase in outdoor activities and dining, driving demand for fresh produce and convenience foods.

- Shifting Consumer Mindset: With rising health awareness, shoppers are increasingly gravitating towards nutritious options, impacting purchasing decisions.

- Promotions and Pricing: Retailers are enhancing their promotional strategies, as shoppers actively seek the best deals, leading to increased in-store visits by 4.5%.

The Shift to Healthier Eating

The emphasis on health has become a critical factor influencing consumer behavior. The NIQ report reveals that a significant segment of the population is actively implementing dietary changes, with 66% of shoppers making choices aimed at improving their health and wellness. This shift is manifested in the growing popularity of products perceived as healthier.

Notable Trends in Healthy Eating

-

Increased Sales of Healthier Products:

- Big pot yogurts: +29%

- Frozen fruits: +21%

- Vitamins: +15%

- Healthier snacks (e.g., rice cakes, sushi): +18% and +15%, respectively.

- Consumer Intent: Around 44% of consumers are focused on reducing their intake of processed foods, while 36% are committed to consuming five portions of fruits and vegetables daily.

Implications for Retailers

The growing demand for healthier products presents both challenges and opportunities for retailers. Retailers must adapt their product offerings and marketing strategies to align with consumer preferences. Mike Watkins, head of retailer and business insight at NielsenIQ, emphasizes that the shift towards fresh and chilled foods indicates a broader trend towards nutritious diets.

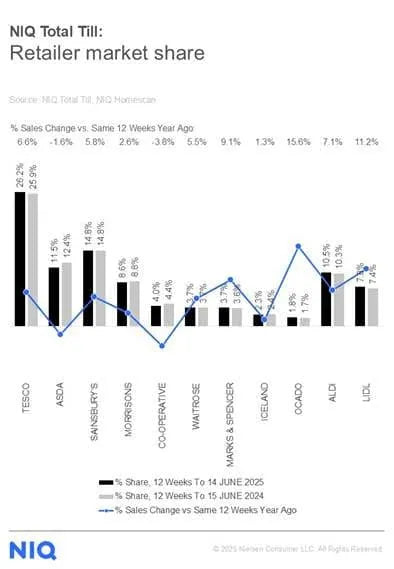

Retailer Performance Overview

Examining the performance of major UK retailers offers insight into how different players are navigating this evolving landscape. Tesco and Sainsbury's have both reported substantial sales increases over the past 12 weeks, benefiting from new shoppers and more frequent visits.

Sales Growth by Retailer

- Tesco: +6.6%

- Sainsbury’s: +5.8%

- Ocado: Leading growth at +15.6%

- Waitrose: +5.5%

This performance highlights how established brands are leveraging their market presence to attract health-conscious consumers while also maintaining competitive pricing.

Consumer Confidence and Economic Outlook

Despite the positive sales figures, underlying concerns about consumer confidence remain. The UK economy continues to grapple with inflationary pressures that affect spending habits. Shoppers are increasingly cautious, as evidenced by the decrease in average spend per visit.

The Role of Consumer Confidence

Economic indicators suggest that while sales are up, the overall sentiment among consumers is mixed. The decline in unit growth by 0.7% reflects a cautious approach, where shoppers prioritize essential items and health-focused products over discretionary spending.

As the summer progresses, the potential for sustained sales growth hinges on both weather conditions and economic stability. A sustained period of warm weather could further bolster consumer spending, as suggested by Watkins, who notes that an extended summer could tip the balance back towards positive unit growth.

Conclusion

The current landscape of UK supermarket sales paints a picture of resilience amid economic challenges. The upward trend in sales, coupled with a clear shift towards healthier eating habits, underscores a significant transformation in consumer behavior. Retailers must continue to adapt to these changes, focusing on product offerings that align with health-conscious trends while remaining competitive in pricing.

As consumers navigate the complexities of health, wellness, and economic uncertainty, the decisions made by both shoppers and retailers will shape the future of the grocery industry in the UK.

FAQ

1. What is the current sales growth rate for UK supermarkets?

Total till sales growth for UK supermarkets reached 3.8% in the four weeks ending June 14, 2025.

2. How has consumer spending changed recently?

While sales have increased, average spending per visit has dropped by 2.5%, reflecting a cautious approach by consumers in light of ongoing inflation.

3. What are the main factors driving the increase in supermarket sales?

Key factors include favorable weather conditions, a shift towards health-conscious shopping, and increased in-store visits as shoppers seek better prices and promotions.

4. Which product categories are experiencing the highest growth?

Significant growth has been observed in healthier food categories, including big pot yogurts (+29%), frozen fruits (+21%), and various vitamins and snacks.

5. How are major retailers performing in this environment?

Retailers such as Tesco, Sainsbury’s, and Ocado have reported substantial sales increases, with Ocado leading in growth at 15.6%.

6. What do consumers prioritize when shopping?

Health and wellness are top priorities for UK consumers, with many actively seeking to improve their diets by limiting processed foods and increasing their intake of fruits and vegetables.

POWER your ecommerce with our weekly insights and updates!

Stay aligned on what's happening in the commerce world

Email Address

Handpicked for You

08 September 2025 / Blog

How to Avoid Greenwashing: Rules, Real-World Examples, and a Practical Playbook for Honest Environmental Claims

Read more

08 September 2025 / Blog

Klaviyo 2025: How its AI-Driven CRM Transforms Shopify Email Marketing and the Customer Experience

Read more

08 September 2025 / Blog