Understanding the Evolution of Consumer Payment Preferences in Europe

Table of Contents

- Key Highlights:

- Introduction

- Online Shopping Is Now Routine

- Payment Preferences Vary by Country

- Cash Still Dominates In-Store Transactions

- Poor Checkout Drives Customers Away

- Security Concerns Remain High

- Interest in One-Click Checkout Grows

- Conclusion

- FAQ

Key Highlights:

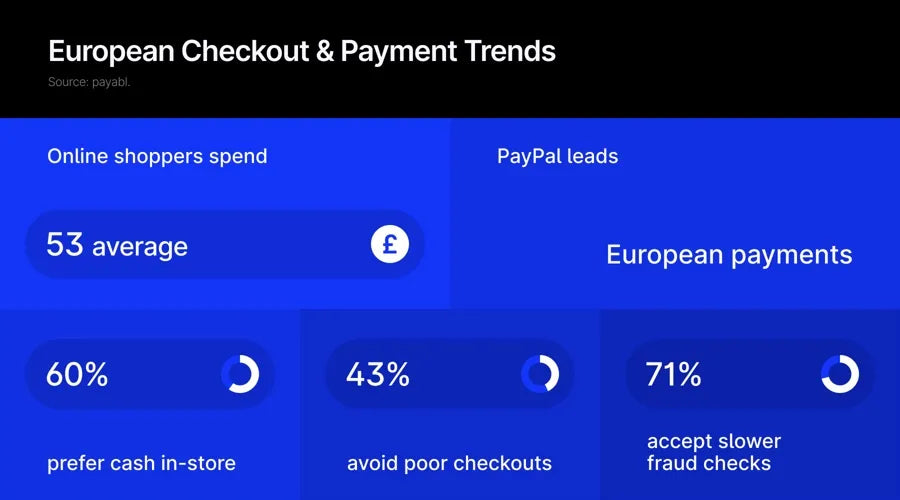

- Changing Consumer Habits: 48% of consumers shop online weekly, with a preference for planned purchases over impulse buys.

- Diverse Payment Preferences: Payment methods vary significantly across Europe; while PayPal is popular, the UK favors debit cards, Germany prefers cash, and the Netherlands opts for iDEAL.

- Impact of Checkout Experience: A poor checkout experience can deter 43% of consumers from returning to a retailer, emphasizing the importance of clear and efficient payment processes.

Introduction

As the retail landscape shifts in response to evolving consumer expectations, the dynamics of payment methods and security measures are undergoing significant transformations across Europe. A recent study by payabl. surveyed 1,400 consumers from the UK, Germany, and the Netherlands, shedding light on shopping habits, payment preferences, and attitudes toward fraud protection. This article delves into the nuances of these findings, highlighting how retailers can adapt to meet the demands of their customers in a competitive marketplace.

Online Shopping Is Now Routine

The digital shopping revolution has firmly established itself, with nearly half of consumers in Europe engaging in online shopping at least once a week. This trend reflects a broader acceptance of e-commerce as a standard component of modern life. The data reveals that 42% of consumers shop online monthly, with an average transaction value of £53. Notably, around 10% of respondents reported spending over £100 per transaction, indicating a segment of consumers willing to invest significantly in their online purchases.

Interestingly, consumer behavior analysis indicates a preference for planned shopping over impulsive buying. Many shoppers are increasingly combining orders to minimize shipping costs or for environmental considerations, illustrating a conscious approach to purchasing that aligns with broader societal values. This shift demands that retailers adapt their strategies to facilitate these planned purchases, potentially offering incentives for bulk buying or promoting sustainable shipping options.

Payment Preferences Vary by Country

Payment methods are not one-size-fits-all, as consumer preferences vary dramatically across different European countries. PayPal stands out as the most favored online payment method across the continent, but local variations are pronounced. In the UK, debit cards dominate, while in Germany, PayPal enjoys a significant lead. Conversely, in the Netherlands, iDEAL emerges as the preferred payment option.

Understanding these regional preferences is crucial for retailers aiming to enhance customer satisfaction. Factors influencing payment choice include speed, convenience, and security, with consumers often prioritizing these elements over familiarity with particular payment methods. Retailers can leverage this insight by offering a diverse array of payment options and considering local payment preferences, which can foster a more inclusive and satisfying shopping experience.

Incentives such as cashback offers, discounts, or faster checkout options also play a pivotal role in encouraging consumers to explore new payment methods, presenting an opportunity for retailers to innovate their payment strategies.

Cash Still Dominates In-Store Transactions

Despite the rise of digital payment methods, cash remains a staple in in-store transactions. A significant 60% of respondents indicated a preference for cash when making in-person purchases, with Germany exhibiting the highest inclination at 67%. This trend highlights a stark contrast between online and offline shopping behaviors, where digital payments are favored in e-commerce, but cash still reigns supreme in physical retail.

The reliance on cash may be attributed to various factors, including a preference for tangible currency and concerns about digital payment security. Retailers need to recognize this divide and ensure they cater to customers' preferences, whether that means facilitating cash payments or integrating contactless card options alongside cash transactions.

Poor Checkout Drives Customers Away

The checkout process is a critical touchpoint in the customer journey, and the findings reveal that a poor checkout experience can significantly deter consumers from returning to a retailer. Approximately 43% of respondents stated they would not return to a retailer after encountering issues during the checkout process, such as hidden fees, mandatory account creation, or unclear payment steps.

Interestingly, while many consumers reported not abandoning transactions in the last six months, the discrepancy with retailer data, which often indicates higher cart abandonment rates, underscores the need for clarity and transparency in the payment process. Retailers must prioritize simplifying the checkout experience to mitigate potential barriers to purchase.

David Birch, Global Ambassador for Consult Hyperion, emphasizes the importance of offering diverse payment preferences, including cards and digital wallets, to enhance the customer experience. By removing potential obstacles and fostering a seamless checkout process, retailers can improve customer retention and satisfaction.

Security Concerns Remain High

Security is paramount in the minds of online shoppers. The report indicates that a substantial 71% of consumers would accept a slower checkout process if it meant enhanced fraud protection. This willingness highlights a growing awareness of online security risks and a desire for greater protection during transactions.

However, there is a notable lack of consensus regarding responsibility for fraud prevention. While 44% of respondents believe that retailers, banks, or payment processors should take the lead in safeguarding against fraud, 25% think consumers themselves should bear some responsibility. The remaining 32% of respondents expressed uncertainty, signaling a gap in communication from businesses about fraud protection measures.

Retailers must take proactive measures to address these security concerns and establish clear communication regarding fraud prevention strategies. By educating consumers about the security protocols in place and the collective responsibility shared in safeguarding transactions, businesses can build trust and loyalty among their customer base.

Interest in One-Click Checkout Grows

As convenience becomes a priority for consumers, the appeal of one-click checkout options is on the rise. Approximately 48% of survey respondents expressed openness to using one-click checkout, provided it is offered by a trusted payment provider like Visa or Mastercard. However, 23% of consumers indicated they would not utilize one-click checkout under any circumstances.

This growing interest presents an opportunity for retailers to streamline their checkout processes and enhance customer convenience. Implementing one-click options can significantly reduce friction during the purchasing process, ultimately leading to higher conversion rates and customer satisfaction.

To capitalize on this trend, retailers should focus on providing clear information about the security and reliability of one-click options. By addressing consumer concerns and emphasizing trusted partnerships with well-known payment providers, retailers can encourage adoption and reassure customers about the safety of their transactions.

Conclusion

The findings from payabl.'s report illuminate the evolving landscape of consumer payment preferences across Europe. As online shopping becomes more ingrained in daily life, retailers must adapt their strategies to meet the changing expectations of their customers. By understanding regional payment preferences, addressing security concerns, and enhancing the checkout experience, businesses can foster loyalty and drive sales in an increasingly competitive marketplace.

FAQ

1. What are the most popular payment methods in Europe?

PayPal is the most preferred method across Europe, but preferences vary by country. In the UK, debit cards are favored, while Germany prefers cash and the Netherlands opts for iDEAL.

2. How does the checkout experience impact consumer behavior?

A poor checkout experience can deter 43% of consumers from returning to a retailer. Key issues include hidden fees, forced account creation, and unclear payment steps.

3. Are consumers willing to sacrifice speed for security?

Yes, 71% of consumers are willing to accept a slower checkout process if it means enhanced fraud protection.

4. What percentage of consumers still prefer cash for in-store transactions?

Approximately 60% of consumers prefer cash for in-person purchases, with Germany showing the highest preference at 67%.

5. How can retailers improve the checkout experience?

Retailers can enhance the checkout experience by offering diverse payment options, reducing friction during the payment process, being transparent about fees, and allowing guest checkouts.

POWER your ecommerce with our weekly insights and updates!

Stay aligned on what's happening in the commerce world

Email Address

Handpicked for You

08 September 2025 / Blog

How to Avoid Greenwashing: Rules, Real-World Examples, and a Practical Playbook for Honest Environmental Claims

Read more

08 September 2025 / Blog

Klaviyo 2025: How its AI-Driven CRM Transforms Shopify Email Marketing and the Customer Experience

Read more

08 September 2025 / Blog