Asda vs. Morrisons: The Battle to Regain Market Share in the UK Grocery Sector

Table of Contents

- Key Highlights:

- Introduction

- The Current Landscape for Asda and Morrisons

- Competing on Value: Price Wars and Promotions

- Enhancing the In-Store Experience

- Streamlining Operations for Profitability

- Asda vs. Morrisons: Who Will Emerge Victorious?

Key Highlights:

- Asda and Morrisons are struggling to maintain their market positions amid increased competition from discount retailers like Aldi and Lidl.

- Both supermarkets are implementing aggressive strategies to boost sales and restore consumer confidence, including price cuts and store upgrades.

- Asda aims to reclaim its third-largest position in the UK grocery market, while Morrisons faces challenges in maintaining its fifth place.

Introduction

The UK grocery sector is witnessing a fierce battle as two of its major players, Asda and Morrisons, attempt to reclaim lost market share and profitability. Faced with stiff competition from discount chains like Aldi and Lidl, both retailers have seen their sales and market positions decline in recent years. As consumer behaviors shift towards value-driven choices, Asda and Morrisons are rolling out a series of strategic initiatives aimed at enticing shoppers back through their doors. This article delves into the current state of these supermarkets, their competitive strategies, and what the future may hold for each in an increasingly challenging landscape.

The Current Landscape for Asda and Morrisons

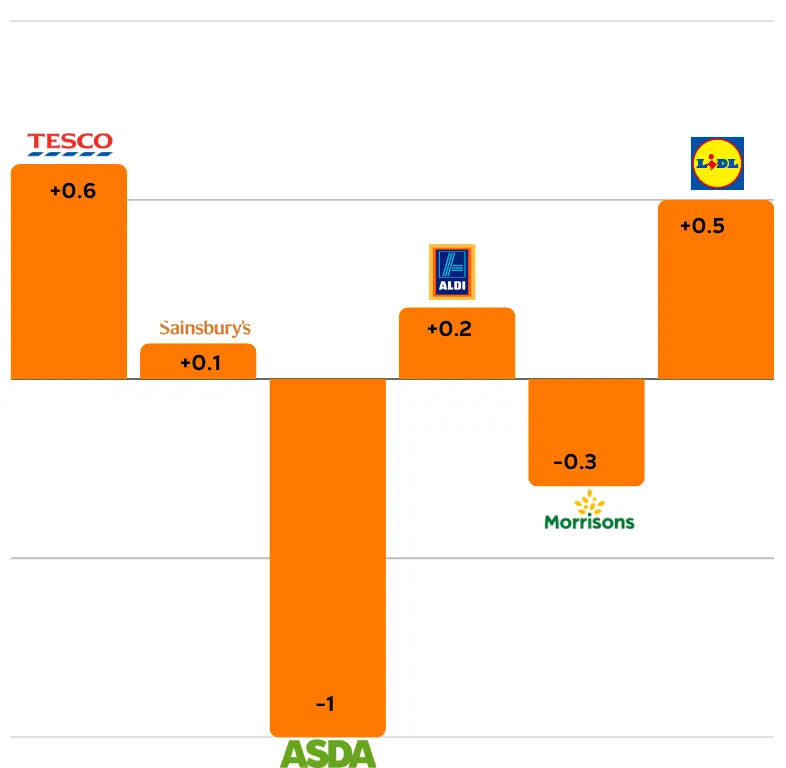

Recent data from Worldpanel highlights the decline in market share for both Asda and Morrisons. Asda's market share dropped to 11.8%, while Morrisons fell to 8.4%. This decline is part of a broader trend as Tesco, Sainsbury’s, Aldi, Lidl, and Ocado gain ground, largely driven by enhanced value propositions and product offerings.

Morrisons' CEO, Rami Baitiéh, emphasized the supermarket's recovery, with sales and profitability improving in recent months. However, despite these positive indicators, Asda's sales fell by 3% in the latest quarter, marking it as the only major supermarket to experience such a decline. Allan Leighton, Asda's chairman, remains optimistic, noting early signs of recovery following a reintroduction of price cuts and promotional campaigns.

The Competition Intensifies

The competitive landscape is evolving rapidly, with discount retailers like Lidl gaining ground. In a recent turn of events, Lidl overtook Morrisons to become the fifth-largest supermarket in the UK, further tightening the race among these grocery giants. Both Asda and Morrisons find themselves under pressure to innovate and adapt to retain their standings.

Competing on Value: Price Wars and Promotions

Asda is leaning heavily on its historical strength in price competitiveness. The reintroduction of the Rollback campaign and the Asda Price Promise aim to restore its reputation as a value leader. The supermarket has reportedly lowered prices on approximately 10,000 products, creating a price gap of 3% to 6% compared to traditional supermarkets.

Consumer group Which? recently reported that Asda has maintained its position as the cheapest supermarket in the UK for the seventh consecutive month. However, industry experts caution that this may not be a sustainable strategy unless it translates into long-term consumer loyalty.

Former Lidl CEO Ronny Gottschlich emphasizes that restoring Asda's price image requires a consistent commitment over years, not just short-term promotions. This sentiment resonates with Leighton, who projects a turnaround timeline of three to five years.

Morrisons, too, is focused on price competitiveness. Under Baitiéh's leadership, the supermarket has been actively price-matching hundreds of products with Lidl and Aldi. The expansion of the More Card loyalty scheme aims to provide meaningful rewards for customers, although analysts express skepticism about its timing and effectiveness.

Enhancing the In-Store Experience

Both supermarkets recognize the importance of the physical shopping experience in attracting consumers. Asda has committed to an investment of £12 million for store upgrades in Yorkshire and surrounding areas. This initiative follows a successful £2 million refurbishment of a flagship store in Greater Manchester. Alongside these upgrades, Asda plans to enhance its in-store cafés with new interiors and digital ordering systems.

In contrast, Morrisons has adopted a more cautious approach, focusing on its Market Street concept to create a premium shopping experience. This strategy entails the introduction of higher-quality products while scaling back on less profitable items. However, there are concerns that these changes might alienate some customers if not executed properly.

Streamlining Operations for Profitability

Baitiéh's turnaround strategy for Morrisons has been centered on cost reduction and operational efficiency. By increasing the savings target from £700 million to £1 billion, he aims to streamline operations and improve profitability. Significant cost-saving measures have already been implemented, including the closure of several cafes and convenience stores.

Morrisons has also engaged in sale and leaseback transactions to manage its debt. The sale of ground leases for 76 supermarkets raised £331 million, showcasing a proactive approach to financial management.

Asda, under Leighton's guidance, is also scrutinizing its cost structure. By prioritizing price cuts over new uniforms for staff, the supermarket demonstrates a commitment to lower prices and customer service. However, industry experts question the long-term viability of this approach and the overall brand identity of Asda.

Asda vs. Morrisons: Who Will Emerge Victorious?

As Asda and Morrisons grapple with their respective challenges, the question remains: which supermarket will successfully navigate the turbulent waters of the grocery sector? Both retailers are under pressure from discount chains like Aldi and Lidl, as well as from traditional competitors like Tesco and Sainsbury's.

Industry analysts suggest that while Morrisons is making strides in cost-cutting and operational efficiency, it must also focus on enhancing its product offerings to win back consumers. Meanwhile, Asda's turnaround strategy appears to be more gradual, with an emphasis on rebuilding customer trust and loyalty.

Leighton’s return to Asda, alongside familiar faces from the past, may provide the needed impetus to restore the supermarket's former glory. The introduction of Darren Blackhurst, a former chief commercial officer, signals a strategic move to revitalize Asda's market proposition.

FAQ

What strategies are Asda and Morrisons implementing to regain market share?

Both supermarkets are focusing on aggressive price cuts, promotional campaigns, and store upgrades. Asda is reintroducing its Rollback campaign, while Morrisons is expanding its loyalty scheme and price-matching with discount retailers.

How is the competition affecting Asda and Morrisons?

The rise of discount retailers like Aldi and Lidl has intensified competition, causing both supermarkets to lose market share. Asda and Morrisons are under pressure to innovate and adapt to changing consumer preferences for value.

What are the financial challenges facing these supermarkets?

Both Asda and Morrisons are managing significant financial pressures, including declining sales and market share. Cost-cutting measures and debt management strategies are essential for improving profitability.

How important is the in-store experience for grocery retailers?

The physical shopping experience remains crucial in attracting consumers. Both Asda and Morrisons are investing in store upgrades to enhance customer satisfaction and loyalty.

Will Asda or Morrisons be more successful in the long run?

While both supermarkets are implementing strategies to regain their positions, industry analysts suggest that Morrisons may have a more challenging road ahead. Asda's gradual turnaround, combined with a stronger brand identity, may give it an edge in the competitive landscape.

POWER your ecommerce with our weekly insights and updates!

Stay aligned on what's happening in the commerce world

Email Address

Handpicked for You

22 August 2025 / Blog

Navigating Customer Experience Trends: Strategies for 2024 and Beyond

Read more

22 August 2025 / Blog

Maximizing Efficiency: A Comprehensive Guide to Customer Service Outsourcing

Read more

22 August 2025 / Blog